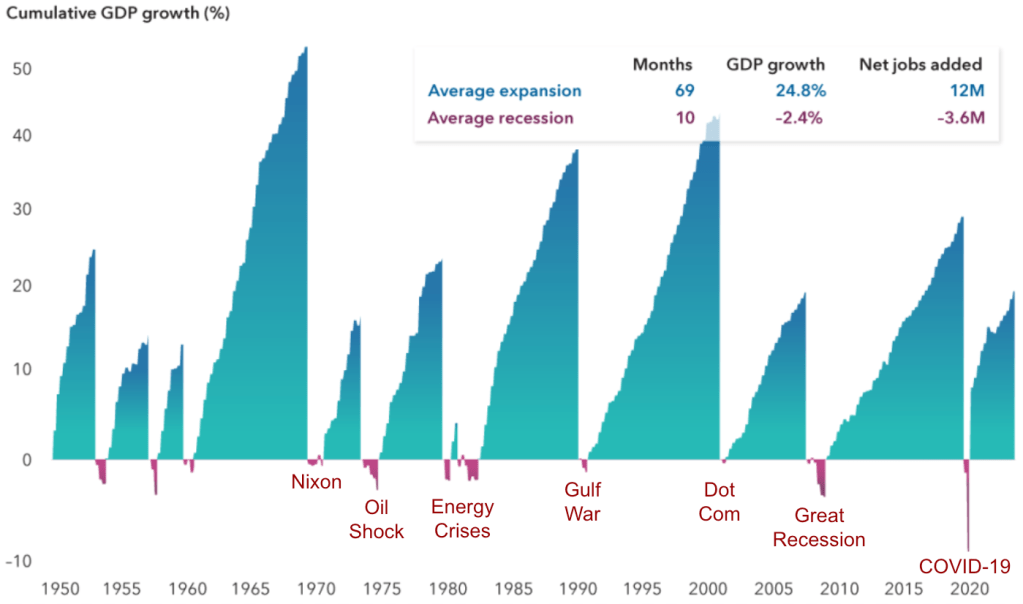

When there is an economic recession, we hear about major losses in stock valuations, job losses, and the impact on retirement savings. Economists worry that Trump’s trade wars could trigger another one, with a market correction and a bear market in the Nasdaq developing in the early spring of 2025. In the past two days, my 403(b), an educator’s version of a 401(k), lost 8% of its value, and I will be retiring in less than 15 months.

However, I’m not panicking. I’ve lived through eight recessions, with half of those coming over the past 35 years of my working life, and my approach for over 30 years has been to employ dollar cost averaging and stay the course, investing a fixed amount of money at regular intervals, regardless of the current market conditions. That reduces the impact of market volatility over time.

I was too young to remember the Nixon recession of 1970, and I have only scattered impressions from the 1973 oil crisis that triggered a recession. However, I was in high school during the twin energy crisis recessions of 1980 and 1981-1982, and those certainly impacted my family, since my father was a petroleum engineer.

Dad was the manager of Gas Measurement for Cities Service, and he survived a takeover attempt by Mesa, a failed merger with Gulf, a merger with Occidental, and then Cities Service Gas being sold off to Northwest Energy and then Williams to pay down the debt from the Occidental merger. He was finally forced out in the Williams acquisition, ending his 35-year career in the petroleum industry at age 58.

My mother continued working at a savings and loan, but those institutions experienced a first wave of failures in that recession. Hers survived until 1991, but it then succumbed, ending her working life at age 54. That was right after the end of the Gulf War recession, the first recession during my own working life.

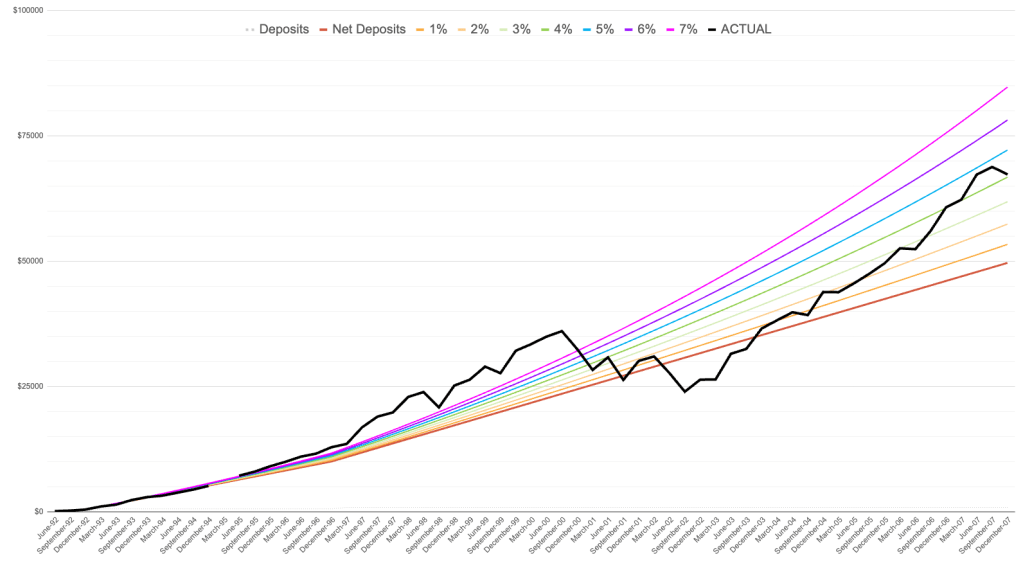

When I began teaching in 1989, my parents ensured that I had an individual retirement account that was added to annually, as they knew how important that would be for me decades later. I’ve always deposited the most I could in my IRA each year throughout my career, but the volatility of the market is better illustrated by my 403(b), in which I have invested about 10% of my gross salary each month since 1992.

I thought it might be instructive to see how it fared through three different recessions, but bear in mind that I am anything but a financial expert. I’m just sharing a fractional view of my own experience, and you should consult a professional financial advisor about your own investments, such as a Certified Financial Planner or Chartered Financial Analyst.

A majority of my 403(b) was invested in the stock market, and by the end of the long expansion of the 1990s I had invested about $24,000 while the account’s value had reached about $36,000. That computed to be a fantastic rate of return, but of course it couldn’t last.

When the Dot Com recession in 2001 struck, I trusted in the power of dollar cost averaging. So I made no adjustments in my investment mix nor the amount of my paycheck that was diverted each month into my ever-dwindling 403(b). By late 2002, I had invested about $31,000 in it, but its value was only $24,000! The recession had wiped out a decade of gains and then some, putting my account well underwater.

However, I knew that my monthly investment was then buying more shares at their reduced prices, and whenever the market finally recovered, my gains would reappear. I wasn’t back above water until the end of 2003, three years after my 403(b) began to tumble, and it never again reached the immense percentage gains of the 1990s. By the end of 2007, I had invested a total of $50,000 over the previous 15 years and the account was valued at $67,000. I calculated my overall rate of return somewhere between 4% and 5%. Nothing to brag about, but I had no financial advisor at the time, and my strategy was building what will eventually become one of my primary income sources in retirement.

Then the Great Recession hit, the longest economic downturn since World War II. My 403(b) again steadily declined, again going underwater.

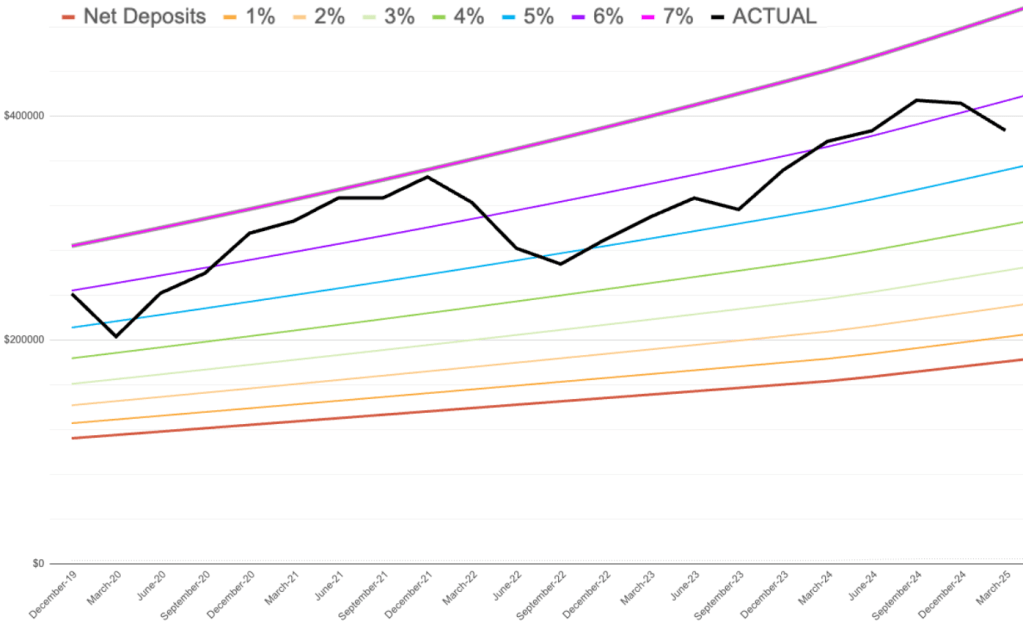

By March 2009, I had invested over $54,000 in it since 1992 but the account was valued at less than $40,000. Again, I stayed the course, continuing to invest. The economy and the market recovered, and my account finally recovered to an overall return above 4% in late 2013, six years after the Great Recession began, and again beating overall inflation.

We then had some downturns and corrections, but there wasn’t another recession until COVID-19 triggered one in early 2020. By then I had invested over $112,000 and my account was valued at over $240,000, and I calculated my overall rate of return at around 6%.

I didn’t just keep dollar cost averaging, as I also needed to periodically assess the mix of assets, primarily how much was invested in higher-risk equities and how much in lower-risk fixed-income assets. On rare occasions, when the market was healthy, I have reallocated funds when my exposure to equities was too high for my comfort. However, I never made such adjustments when the market was down, as I wanted to lock in gains, not losses.

To keep my own amateur adjustments to a minimum, for some years I have kept most of the account in a Lifecycle Index 2035 fund, which gradually becomes more conservative in its investment mix over time. It currently has about 2/3 of its assets in equities and 1/3 in fixed-income assets. That will reach an even split in 2035 and by 2065 will be 20% equity and 80% fixed-income, although it seems unlikely I’ll still be around to witness that.

The COVID-19 recession didn’t impact my account nearly as much as the earlier Dot Com and Great recessions. My overall rate of return at first dipped to less than 5%, recovered over the next two years to reach almost 7%, but then dipped again in 2022.

Since then it gradually rebuilt to above 6%, and this week it dove to about 5.5%. I realize it could dip much lower before I retire in June 2026, when my deposits will stop. However, I don’t expect that impact on one of the legs of my retirement stool to delay my retirement nor reduce my withdrawal plans. My parents left the workforce at ages 54 and 58, right after recessions, yet they enjoyed long and comfortable retirements. It certainly helps that in addition to individual retirement accounts and 401(k)/403(b) plans, both my father and I were able to pay into defined-benefit pension plans that were shielded from market volatility, although their fixed payouts don’t offer protection from inflation.

I will keep my money invested, trusting that no matter how low the markets get, they will eventually rebound and my retirement assets will be rebuilt. My own experience is that could take a half decade or more after a big recession, but hopefully I have plenty of time. My father lived to age 97, my mother is enjoying independent living in Bartlesville at age 88, and I have a 50% chance of lasting another 30 years..and I fully intend to be retired for almost all of them.