Back in June 2024 I wrote about Oklahoma Teacher Retirement. Now, in early 2026, my preparations have begun for my mid-year retirement, which will occur about a month before I reach 60 years of age. I have filed my application with the teacher retirement system, agreed to new segmented accounts for the monies I’ve accumulated in various retirement funds, and arranged my post-retirement/pre-Medicare health insurance.

Retirement Funding

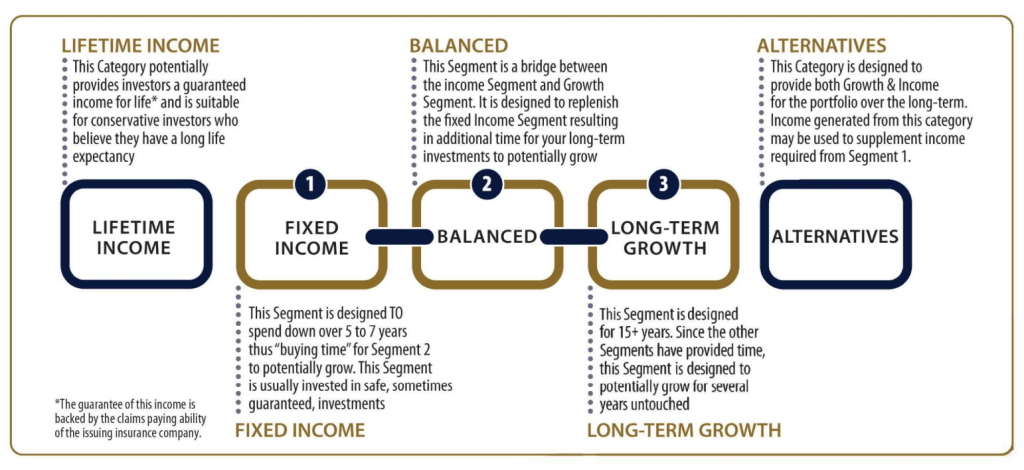

I selected the pension option where if I die before her, my wife will receive my monthly pension for the remainder of her life. I also opted for a Partial Lump Sum distribution which will be combined with the traditional IRA I contributed to from 1989 to 2014, the Roth IRA I have contributed to since 2015, and the 403(b) plan I have contributed to since 1992. All of those funds will flow into various accounts per an Advanced Time Segmentation plan.

I opted for a Partial Lump Sum, which reduced my pension by 17%, in order to boost my total investments pool as a hedge against inflation. That is important to me since the Oklahoma Teacher Retirement System (OTRS) stopped providing annual cost-of-living adjustments (COLAs) long ago. The legislature only rarely provides tiny adjustments, the last being a 2-4% increase in 2020 after a dozen years without one, while the Consumer Price Index increased by almost 50% between 2008 and 2025.

I plan to start drawing my Social Security retirement benefit in a couple of years when I turn 62. Three factors motivated my decision to take it as soon as possible:

- Social Security benefits, unlike OTRS, do have annual COLAs, based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers. That will help offset health insurance/Medicare cost increases.

- The dysfunctional federal government has done nothing to stave off the exhaustion of the Retirement & Survivors Fund in 2033, meaning there could be benefit cuts of up to 23% in the coming years. Best to get whatever I can, as soon as possible, since Congress and the President might eventually allow benefits to drop significantly, decrease or suspend the annual COLAs, etc.

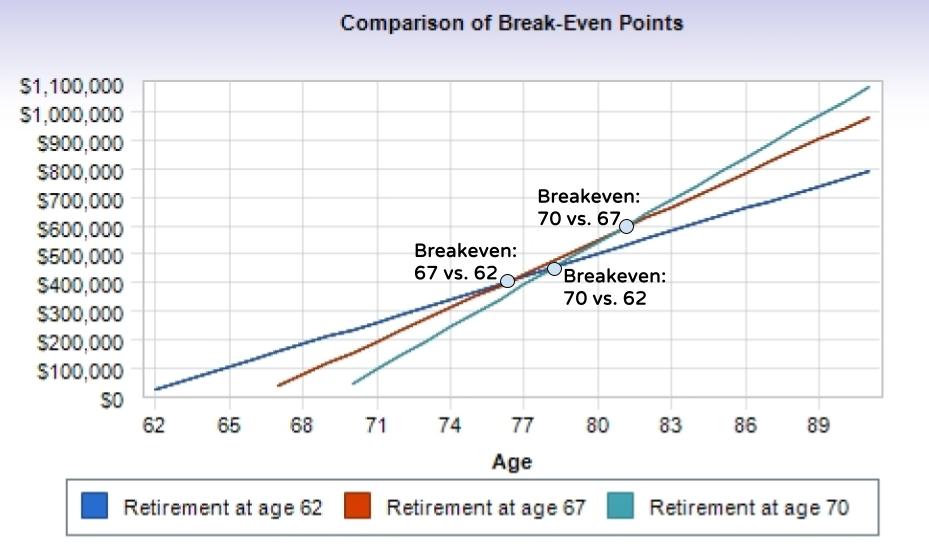

- Even if Congress somehow protects my Social Security benefit, waiting to collect it until age 67 would not increase my lifetime payout until I am over 75 years old, if I even survive to that age. I’d rather enjoy those benefits for over a dozen years when I’m younger and healthier.

Bear in mind that calculation does not factor in COLAs or the unknown changes in Social Security that must occur within the next seven years. My stance on Social Security might be different if I lacked my teacher pension and had not spent decades building up my retirement savings.

Health Insurance

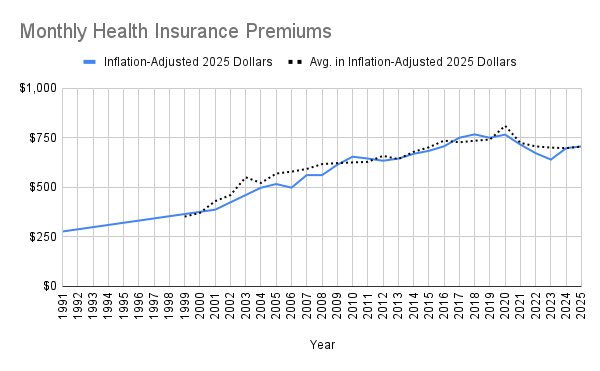

My health insurance has evolved over time. When I began teaching in Bartlesville in 1989, the district had a self-funded plan. As of 1991, the monthly premium was $118, or $277.29 in 2025 dollars adjusted for inflation according to the Consumer Price Index. Now the monthly premium is $707.00, with the inflation rate for health insurance premiums being much higher than for the overall economy.

Oklahoma teachers’ premiums for HealthChoice High insurance have been fully paid by the state since 2004. At the time, the monthly premium was $292.54 or $498.15 in 2025 dollars. The chart below tracks my monthly health insurance premiums, in inflation-adjusted 2025 dollars, and compares that to the average among firms in the South employing 200-1000 workers.

It is no surprise that the health insurance costs have increased far above the overall rate of inflation. Over the course of my career, the real cost of health insurance increased by a factor of 2.5, although it has stabilized over the past decade. However, I have been insulated from those increases for over 20 years because Oklahoma began paying for public school educators’ single health insurance premiums in 2004.

For the five years until I qualify for Medicare, I’ve opted to stay with the state’s HealthChoice High insurance plan. The retirement system will pay $102/month towards my premium, which will start out at $707/month plus $48.58/month for HealthChoice Dental insurance. I’m also keeping an American Fidelity cancer and intensive care unit insurance policy I obtained in 2009 which costs me $32.45/month.

So for five years I’ll be paying out-of-pocket at least $686 per month or $8,232.36 per year for health, dental, and cancer insurance until I qualify for Medicare. Given the structural defects in our health care system, I won’t be surprised if the cost of my health insurance rises above the overall rate of inflation.

Oklahoma ranked 49th in health care among the states and the District of Columbia, with only Texas and Mississippi below us. Our state is 48th in health care access and affordability and is among the bottom-five in a slew of categories: uninsured adults, Medicare spending, adult cancer screenings, dental visits, COVID-19 vaccinations, children without mental health care, avoidable emergency department visits for the elderly, premature deaths from treatable and preventable causes, suicide rate, colorectal cancer deaths, smoking, adults lacking care due to cost, children’s medical and dental visits, and hospital admissions. None of that helps my insurance costs.

Transitional Period

A decade ago, when I agreed to occupy a new district administrative position over technology and communications, the school board president of the time, the superintendent, and I acknowledged that the position was an unusual one unlikely to survive my tenure. I had a specific role to play in modernizing those aspects of the district, and now that mission has concluded. In the summer of 2026, the district will have a new superintendent, and she has begun the process of establishing a new administrative structure.

My roles will be spread among multiple administrative positions, and I have crafted a multi-year roadmap and instructions that could be used to sustain the district’s technology and communications programs while they evolve into new forms. New central office administrative positions have been posted and should be filled in a few weeks.

I’ll then begin a transition process with the new administrative designees, and at some point I will vacate my office at the Education Service Center. My retirement reception is set for May 19, 2026 and I’ll officially retire on June 30, a day before Wendy and I celebrate our tenth wedding anniversary.

Wendy is nine years younger, so after I retire she will continue to lead the Student Technology Support Team at Bartlesville High School, working with students to maintain the thousands of Chromebooks used across the school district.

The time of transition has arrived. As Fred Rogers wrote, “Transitions are almost always signs of growth, but they can bring feelings of loss. To get somewhere new, we may have to leave somewhere else behind.”

Enjoy your retirement! You have worked hard to prepare yourself financially. I’m sure you’ve worked equally hard in preparing yourself emotionally. It’s a big step, but one that is so worth it. Come on over to the other side! It’s lots of fun over here!